- ESG Sum

- Posts

- ESG Sum

ESG Sum

2024: ESG goes from the board room to the ballots

ESG Sum is the free weekly newsletter that curates global sustainable financial news, moves and memes. Whether you’re a seasoned professional or preparing for your first interview in sustainable finance, subscribe and tap into the ESG grapevine at your desk or on the go.

Good morning,

2024 has been far from quiet for the ESG cartel, AI, climate & nature were hot topics at Davos, the term ESG might be getting a rebrand, climate policy hangs in the balance as the UK, EU and US go to the polls and UKSIF respond to FCA on anti-green washing rules.

Let’s go!

Chart of the week

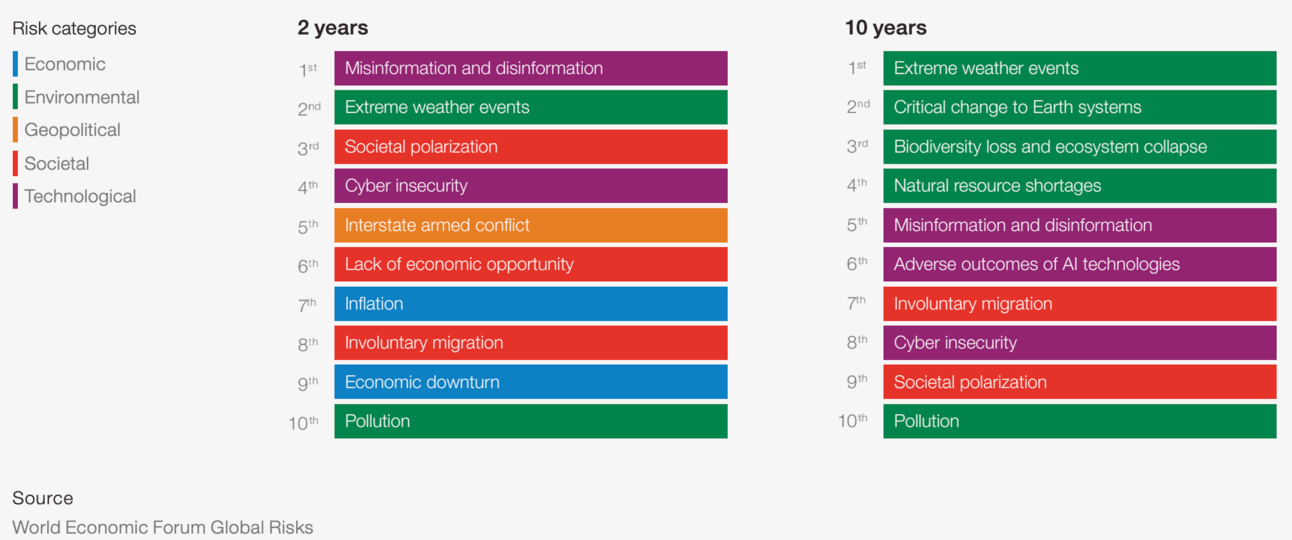

The World Economic Forum released its annual global risk report, short term risks remain volatile due to in going geopolitical events but environmental risks dominate the longer term risk horizons.

Misinformation and disinformation has emerged as the most severe short-term risk, with +3Bn people going to the polls over the next 2 years.

Geopolitical tensions combined with technology will drive new security risks.

Environmental risks continue to dominate the risks landscape over all three time frames, in particular extreme weather events.

Biodiversity has increased to 3rd position as a 10 year risk with an increased focus on the rate of irreversible nature loss.

Global Headlines

Global investment in the energy transition hit $1.8 trillion in 2023. read more

ESG KPIs increasingly influence executive comp in North American companies. read more

CFA UK launches new certificate in Impact Investing. read more

Elon Musk’s $56 billion Tesla compensation voided. read more

Nextracker CEO says ‘solar is unstoppable’. read more

Google unveils largest ever offshore wind investment with PPAs for 700MW of clean power in Europe. read more

China’s renewable energy capacity forecast to overtake coal in 2024. read more

Exxon pursues lawsuit despite activist investor climb-down. read more

Fixing the broken food system could unlock trillions of dollars in benefits. read more

TNFD announces the inaugural cohort of Early Adopters. read more

Asset Managers

U.S. sustainable funds register 1st annual outflows in 2023. read more

Morgan Stanley survey finds 54% of individual investors plan to increase sustainable investment allocations. read more

Mirova raises +$280M for EM climate fund. read more

Calvert launches three new Article 8 ESG funds. read more

Janus Henderson & Man Group upgraded in Morningstar's latest 'ESG Commitment Level' review. read more

Macquarie AM raises largest European infra fund. read more

ESG Investing Awards 2024: Shortlist Announced. read more

Asset Owners

Alberta pension manager launches C$1 billion energy transition fund read more

Capital Markets

Alternatives

Hedge funds betting on ‘dramatic’ gains in copper stocks. read more

ESG policy may be leaving the private markets behind. read more

UK carbon price falls to record low. read more

KKR raises $6.4 bln for biggest Asia Pacific infrastructure fund. read more

Generate Capital Raises $1.5 Billion from Calstrs. read more

Planet A Foods, a B2B sustainable ingredients company, announced $15.4 million in Series A funding. read more

ArcTern soars past target, raising $335M for scalable climate tech. read more

Schroders Greencoat launches new energy transition fund. read more

Hy24 invests €13mn in clean hydrogen solutions. read more

Politics & Regulation

FCA barred ETFs from new UK sustainable investing regime. read more

The European Commission adopts new regulations to eliminate 500 million tonnes of CO2-equivalent emissions by 2050. read more

Biden administration pauses LNG export approvals, citing climate concerns. read more

Trump vows to ‘drill, baby, drill’. read more

EU SFDR sparks shift towards sustainability in private funds. read more

Movers & Shakers

Podcasts, Papers & Events

ESG on a Sunday (weekly) Blog

Business Pants: Woke Wednesday (weekly) Podcast

The Private Equity Wire European ESG Summit: (London, 28 Feb) Event

PEI 2024 Responsible Investment Report. Paper

Morgan Stanley Sustainable Signals 2024. Report

Alex Edmans, London Business School, ‘Rational Sustainability’. Research paper

MSCI, Sustainability and Climate Trends 2024. Replay

ESG Meme Stocks

London based analysts grinding over the weekend during Six Nations…

Compliance teams tracking global sustainable finance regulations…

FCA following up on investment manager’s green claims in 2024…

ESG Sum is an independent venture and not affiliated with any 3rd party entity, any and all views expressed in this newsletter are solely those of ESG Sum and are not considered an endorsement, investment advice or a financial promotion.